Services

Accounting Services

Bookkeeping

Additionally, KNM Financials can reconcile your business records and accounts with bank, credit card and loan accounts; we can make sure that your accounts are reconciled with your liabilities for the most accurate record keeping we can provide. Our bookkeeping and payroll services are designed to fit within your busy schedule: we offer two different approaches in order to best accommodate you. If you prefer an in-person approach to handling your bookkeeping needs KNM Financials can travel to your office. Alternatively, with remote access, file sharing and Quickbooks online we can balance books remotely.

Payroll Services

Payroll is arguably the largest expense for businesses, and running it can be a daunting task. The process can be time-consuming, and errors can result in both unhappy employees and fines. We’ll calculate, pay, and file your federal, state, and most local payroll taxes. We have the ability to initiate a wide range of self-service actions, so that the employees do not have to ask you!

tax services

Business Tax Services

with strategies that minimize you tax liabilities and maximize your compliance. We have the tools and expertise to prepare virtually any tax return and most can be filed electronically with the taxing authorities. Tax compliance services include the preparation of both federal & state returns for:

- Partnership Income Tax (1065)

- S-Corporation Income Tax (1120-S)

- Estate Income Tax (1040)

- Non-profit (990)

- Sales Tax (Texas)

- Mixed Beverage Tax (Texas)

Individual Tax Services

Taxes can be intimidating for many. The staff here at KNM Financials will professionally prepare your tax return. Not only do we review the taxes with you, but it is reviewed by our quality control team that will ensure accountability for every tax return that is processed through our company. Our regard to accuracy while maintaining highly efficient service output is the company standard.

Business Tax Planning cont.

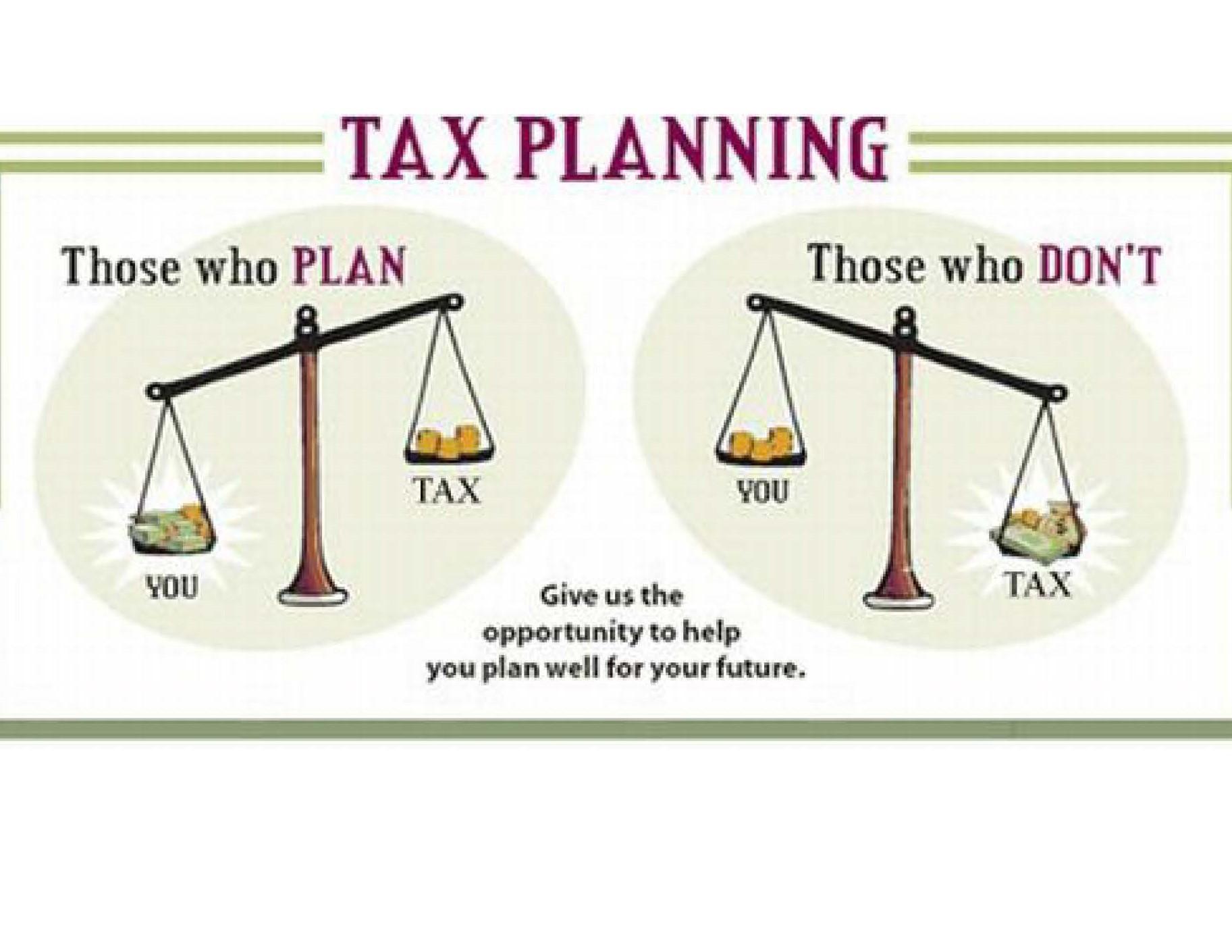

Tax Planning

The amount of tax that your business needs to pay is correlated with the decisions and actions that you take during the year. Let KNM Financials help:

- Reduce the amount of taxable income

- Lower tax rate

- Control the time when taxes must be paid

- Claim available tax credits

- Control the effects of the Alternative Minimum Tax

- Avoid common tax planning mistakes

Rather than simply completing documentation at the end of the year, we will work with you to develop a tax strategy that will ensure that you take the steps required to keep more money in your business. This will enhance the profitability by reducing the outlays. Let us help to see if you can take advantage of:

- Tax efficient savings account

- Deferral of income

- and other tax reduction strategies

KNM Financials can also help to prevent misunderstandings, mistakes, or missed deadlines that could increase your tax liability.